At Sustainable America we find this article from 13D Research interesting and on point. We believe it helps highlight the vulnerabilities of our economy to global oil supply, and the need for reducing our reliance on oil for transportation uses.

The following article is republished by courtesy and permission of 13D Research.

The real game-changing event in energy: Global crude-only production has been flat for seven years.

We have often argued that blind faith in the notion that “technology and innovation will save us,” in reference to energy, transportation, or any other walk of life, could be a mistake. The widespread belief that there are no limits to the human ingenuity and the ability to adapt quickly to changing circumstances is overrated, in our view. Case in point: despite numerous warnings since the early 1970s that the liquid fossil-fuel era was in its latter stages, the world’s vehicle fleet—mostly powered by crude-oil derived fuels—has quadrupled.

Moreover, this happened despite the fact that the global benchmark crude oil price has risen from less than $3 a barrel in nominal terms during the early 1970s to more than $100 today. New technologies may have enabled the world to improve its fuel efficiency, but by and large, the world’s transportation system is still reliant on technology that is more than a century old. This, more than anything, leads us to question just how quickly human ingenuity can adjust to the new economic reality based on three pillars—the peak of global conventional crude oil, a stifling level of public and private sector debt that approximates $200 trillion globally (310% of global GDP), and the worst demographics in 500 years. From an investment standpoint, this implies a persistent compression of P/E multiples as the long-run assumed rate of economic growth will be under pressure for some time.

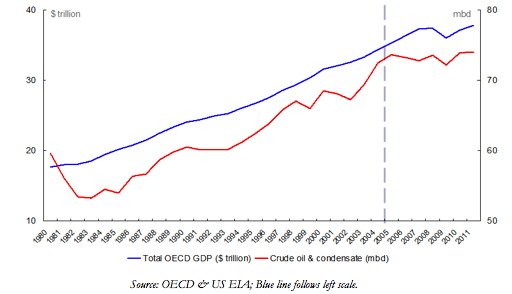

Last week, we wrote how the real “game changing” events are rarely seen in advance, but normally only with several or many years of hindsight. In our view, the real “game changer” with respect to energy and the economy is not the emergence of shale oil, or low natural gas prices in the U.S., but rather the fact that the flattening of the “crude only” production curve that began in 2005 occurred almost simultaneously with the flattening of the OECD real GDP curve that began in 2007. Could these events be related? We certainly think they are, and that the buildup of excessive levels of debt has gone hand-in-hand with the inability of the developed world to grow without abundant incremental annual crude oil supply.

OECD Real GDP vs. “Crude-Only” Production,

1980 to 2011

In our view, the vertical line in the prior chart marks the real “game changer,” and everything perhaps else is only a reaction to that original game-changing event. This is a contrary view, if ever there was one. No doubt, many observers will disagree with this assessment. However, we think it is worth pondering the evidence supported by the prior chart before dismissing this thesis, as well as to consider the wisdom of venture capitalist, Peter Thiel (see related reports), on the subject of technological innovation. In a recent interview with Trey Grayson of the Institute of Politics, Thiel commented on innovation (or lack thereof) in the energy and transportation sector as follows:

> Well, the question I tried to pose is how much technological progress is happening? Are we still living at a time of accelerating technological change? And, the answer was that we are seeing it in computers, [and] the internet, and basically nowhere else. And, you know, [to illustrate] where we’re literally not moving faster is in transportation. Where you know if you looked at every decade from 1500 onward, you had faster sailing boats, faster railroads in the 19th Century, they have faster cars, faster airplanes, and basically, today basically, we’re at the levels of 1970 if you include [that] low-tech airport security systems may go back to 1960 levels and you know the Concorde was authorized in 1976, decommissioned in 2003 and so that’s one place where things have definitely not continued to accelerate. If you broaden it from that to energy, things have basically been stagnant. If you define technology as doing more with less, energy has had the opposite aspect where so much of it has involved things that are ever more expensive. And, so even though oil prices are far above the levels of the early 1970s, alternate energies are costing even more. And so we’ve had sort of a failure both on the conventional side and to date, a very serious failure in alternatives, which are costing more and so there are a lot of questions of what’s gone wrong in that area?

Reasonable people can respectfully disagree as to whether the “crude only” (red) line in our chart marks only a temporary pause or is indeed a semi-permanent plateau that has already persisted for seven years. Only time will answer that question. What really matters, in our view, is that the world is now forced to exploit oil reserves that cost three or four times the incremental oil that was supplied cheaply and abundantly for 25 years and supported meaningful and sustainable economic growth during that time. It seems reasonable to conclude that the most seminal event of our time is not well appreciated, judging by some of the commentary we have read concerning this very complex issue.

Part of that complexity involves the global abundance of debt that coincided with the abundance of relatively cheap oil. A decade ago, the late investment banker and author, Matthew Simmons, used to emphasize the need for a “Marshall Plan” for global energy, i.e., transitioning the world economy away from conventional crude oil would potentially require $30 to $40 trillion of investment—an unprecedented sum that nevertheless would have a silver lining, in that it would provide enormous opportunity for gains in middle-class employment.

However, one must wonder how we could possibly accomplish this today, with the global banking sector reeling from successive crises and stricter regulatory demands, not to mention a level of private and public sector indebtedness that approximates $200 trillion, compounded by the worst demographics in 500 years that ensures that government borrowing to pay for social support programs will continue indefinitely. Does not the global credit system have to be fixed and substantially de-levered before serious thought can be given to embarking on a Marshall Plan for energy?

A March 2010 white paper entitled “The $100 Billion Question,” by Andrew G. Haldane, Executive Director of Financial Stability for the Bank of England, estimated that the financial crisis of 2008-2009 could result in a permanent long-term loss of prospective global GDP ranging from $60 trillion to $200 trillion, under different scenarios. This estimate, however, occurred before the current sovereign debt crisis, which probably raises the likelihood that the higher end of that range will apply—a fact that most certainly will have an impact on the world’s ability to cope with high oil prices and high debt levels, which together exert a negative feedback effect on growth.

One of our biggest concerns remains the dangers of inductive reasoning. Similar prognostications about diminishing growth were made in the 1970s, highlighted by the Club of Rome and The Limits to Growth, which then became easy to dismiss with the accelerating global prosperity of the 1980s, 1990s and 2000s. However, one must ask if the growth of the past three decades was largely due to non-repeating factors? If so, then the blind reliance on perpetual innovation could be vastly overstated. The economics journalist for The Washington Post, Robert J. Samuelson, penned an insightful essay for The Claremont Institute entitled “Reckless Optimism,” which examined this issue in greater detail. We quote:

> People, businesses, and governments borrow for one of two reasons: hopeful optimism or fearful desperation. If it’s the first, borrowers see a rosy future…Desperate borrowers, by contrast, are up against the wall…By and large, the borrowing that led to the devastating 2007-09 financial crisis was of the first type…So we return to the original question: what caused the optimism? The main answer was faith in economic progress. We seemed to have conquered the worst economic instability.

> After the harsh 1981-82 recession, with unemployment reaching 10.8%, there had been only two recessions, those of 1990-91 and 2001. Both were mild and brief. Recessions that might have happened but didn’t, strengthened this confidence. The Fed seemed capable of defusing broad economic or financial setbacks. It had done so after the 1997-98 Asian financial crisis, after the collapse of the hedge fund Long-term Capital Management in 1998, after the popping of the “tech bubble” in 2000. Globalization was raising living standards around the world and, despite problems, suggested a consensus favoring the free flow of goods and money.

>Economic life seemed less risky. People and institutions adapted their behavior to a world that seemed to have grown safer and was likely to go on getting safer still. Households could take on more debt because the infrequency and mildness of recessions improved their ability to service the debt. Lenders could be more accommodating for similar reasons: borrowers were better bets than before. Players in financial markets could be more adventurous, because the world was less risky. They could finance their trading and investments with more short-term debt, because the dangers of borrowing too much had receded. Government regulators could relax, because financial hazards had, it seemed, retreated. In short, good times bred over-confidence and complacency…

>With hindsight, the quarter-century between 1982 (when the then-harshest post-World War II recession ended) and 2007 (when the now-harshest recession began) was a period of extraordinary economic placidity. Although there were problems and setbacks—and many complaints about them—they were usually handled without large and lasting damage. People at all levels (business managers, government officials, economists, investors, ordinary workers and consumers) made increasingly optimistic assumptions about the economy, which influenced how they thought and behaved. They began to regard semi-permanent prosperity, periodically interrupted by mild slumps or passing financial scares, as the new and enduring normal.

>In short, we lulled ourselves into a false sense of security. The very belief that we had entered a new era of ever diminishing risk and ever growing prosperity led to decisions by governments, investors, businesses, and consumers that augmented risk and jeopardized prosperity. The crisis that began almost four years ago, and whose destructive effects still assail us, is the price we are paying for having been wrong.

Samuelson’s analysis has important implications for investors. Hope in the human ability to adapt and innovate may indeed work out over the very long term, but over the next decade or two, innovation will require huge investment and wherewithal, which do not yet appear to be forthcoming. Judging by the last forty years of economic expansion supported by increasing debt and cheap oil, this “hope” may not play out during the foreseeable investment horizon as it did over the past thirty years.

If, as we believe, the 2005-2007 inflection point in the trajectory of oil supply, private sector credit and economic growth are all inter-related, then a reassessment of potential equity valuations is in order. Equities remain inexpensive by historical valuation parameters and are much better investments than government bonds on the basis of earnings, cash flow and dividend yield. However, part of the history that is invoked in the historical valuation analysis includes the 1982-2007 period highlighted by Samuelson above. Therefore, unless companies are acquired outright, the inexpensiveness which seems so unusual now could in fact persist for some time.